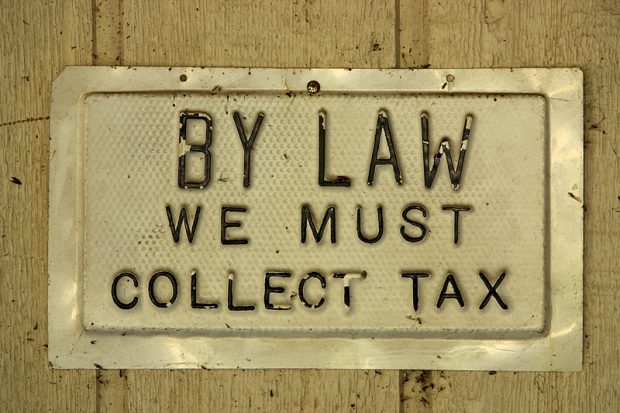

Nebraskans will be paying sales tax on items purchased online next year if lawmakers act during the upcoming legislative session. The U.S. Supreme Court earlier this year ruled that states can collect sales tax on online purchases even if the company had no brick and mortar location there. Creighton University Economist Ernie Goss says that extra tax revenue will generate about $105 million.

Shoppers aren’t wasting time spending their holiday dollars. Goss says sales were brisk during Black Friday and Cyber Monday.

Goss says Nebraska is collecting the lowest percentage of sales taxes among bordering states so the internet sales taxes will probably be used to help offset the highest property taxes in the region.