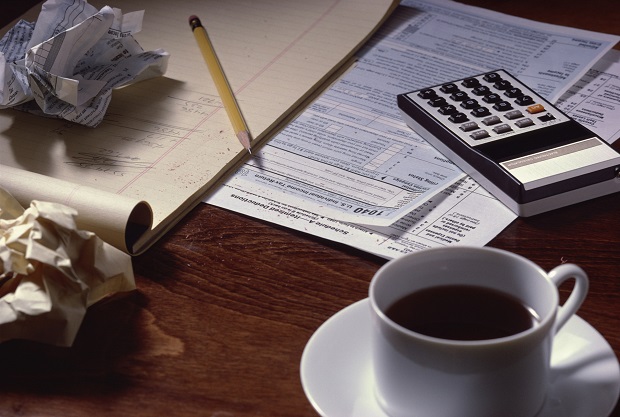

State tax collections increased just one percent over the past three months, far short of the more than seven percent revenue growth that was projected. Legislative Services Bureau analyst Jeff Robinson says it’s too early to detect a big trend, though.

The state fiscal year started July 1st. During July, August and September, Iowans HAVE paid about four percent more in income taxes to the state.

The State of Iowa has paid a higher-than-normal amount of income tax refunds in the past three months. State sales tax collections have grown more than three percent in the past three months, but Robinson cautions some of that growth came from accounting transactions that aren’t related to actual retail sales. The three-member panel of financial experts who set the official prediction for state tax collections will meet October 13th.