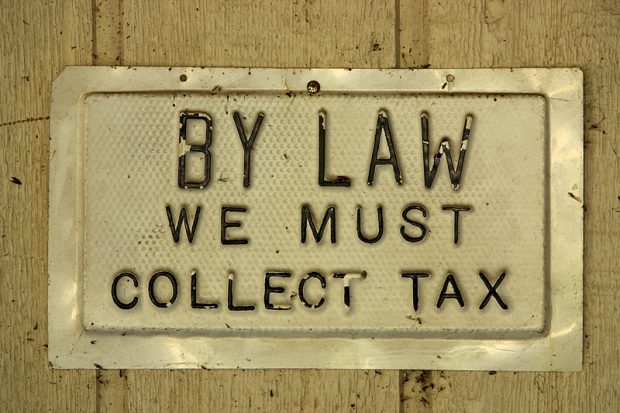

An Informa study released last week shows proposed changes to the tax code restricting the use of cash accounting by agricultural operations would reduce producer’s access to capital. That reduction is estimated by as much as $ 12.1 billion over the next four years. Iowa Farm Bureau President Craig Hill says that change from cash basis to accrual basis accounting would have a devastating impact.

The Informa study also said that under the next tax proposed laws, farmers and ranchers would have to pay out as much as $ 4.84 billion in taxes over the next four years. Hill says that means producers would no longer have fund available to buy tractors and combines or invest in labor and inputs.

Hill agrees with what the study points out and that cash accounting allows producers to better manage volatility and risk.